View related analysis:

- Tentative Signs of a US Dollar Rebound

- Japanese Yen (JPY) Sentiment Could Be at an Extreme: COT Report

- AUD/USD, AUD/CAD, GBP/AUD Analysis: Australian Dollar Falters

- EUR/AUD Analysis: April’s Candle is Eerily Similar to 2008, 2020 Highs

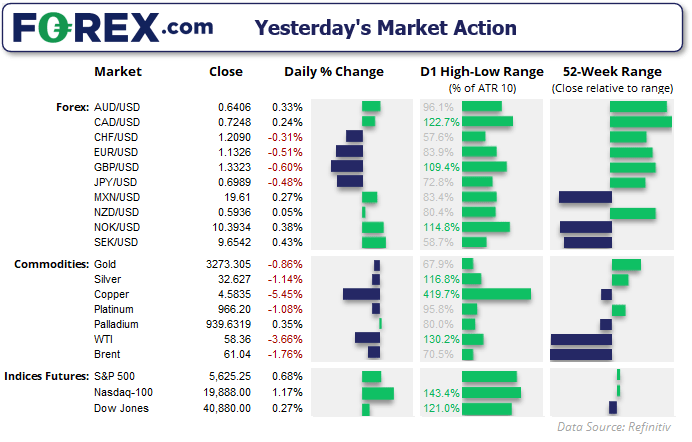

A couple of weeks ago I outlined a case for a bullish reversal on the US dollar. While it seems to be taking its time and remains at risk of another leg lower, tentative signs for a bullish reversal remain in place looking at price action clues on USD/JPY, USD/CHF and EUR/USD.

US Economic Backdrop: GDP, Tariffs and Inflation Pressures

The US economy contracted for the first time in three years in Q1, according to the latest GDP report, with a surge in tariff-induced imports and a lack of government spending largely to blame. Imports jumped 41.3% as firms rushed to pre-order goods ahead of Trump’s tariffs — a move seen as a one-off that’s likely to reverse in Q2 as the tariffs take effect. From this perspective, the -0.3% y/y contraction in GDP could have been much worse.

While underlying spending remained strong, core PCE rose to 3.6% y/y. However, the monthly PCE inflation report came in softer than expected, which helped soothe stagflation fears to a degree. Still, against the backdrop of weakening consumer sentiment and a decline in job advertisements from separate reports, we’ve yet to see the full impact of Trump’s tariffs and nothing should be taken for granted.

BOJ, ISM Manufacturing and Nonfarm Payrolls Reports in Focus

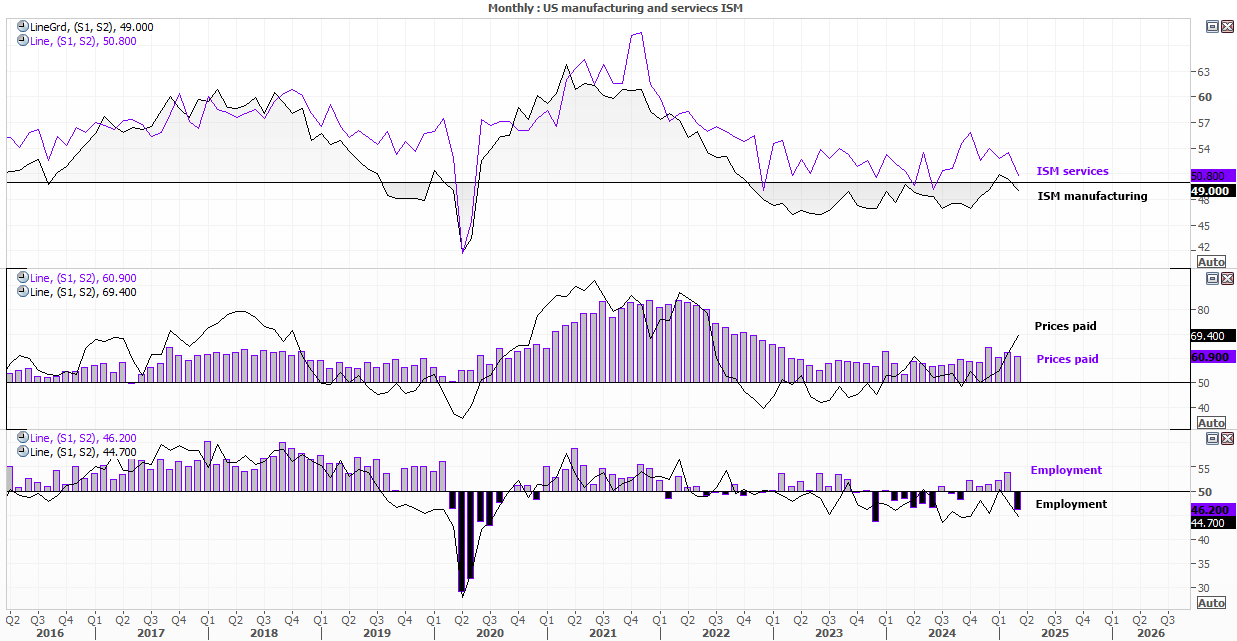

It will be interesting to see how the ISM manufacturing report plays out in light of Trump’s tariffs, given the stagflation fears they stirred in the March report. The headline PMI contracted to 49, while the prices paid component surged to a two-year, nine-month high. New orders also contracted at their fastest pace in nearly two years, and the employment index fell at its fastest pace in eight months. These figures could be set to deteriorate further, as Trump has since unleashed triple-digit tariffs on Chinese imports.

Economic Events to Watch (AEDT)

- 10:50 – Japanese manufacturing PMI

- 11:30 – Australian trade balance

- 12:30 – BOJ interest rate decision, monetary policy statement (times may vary)

- 16:30 – Australian commodity prices

- 18:30 – UK manufacturing PMI, M3 money supply, bank lending, consumer credit

- 21:30 – US job cuts

- 22:30 – Canadian manufacturing PMI

- 23:45 – US manufacturing PMI

- 00:00 – US ISM manufacturing

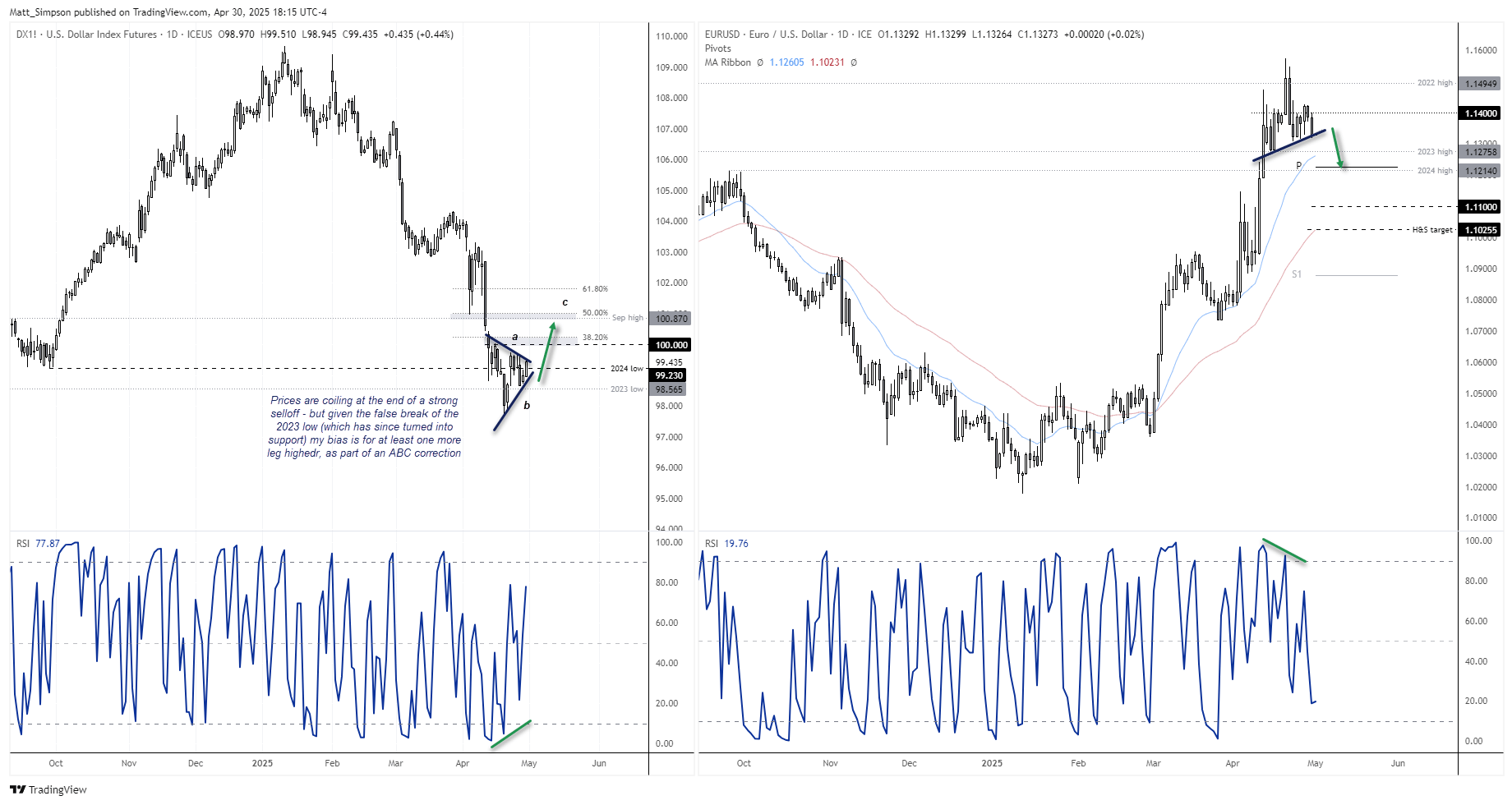

US Dollar (DXY), EUR/USD Technical Analysis

The dollar saw a false break of the 2023 low on 21 April, and prices have since turned that level into support. While it’s possible that prices are coiling for another leg lower, given the extended sell-off in the US dollar, my preference is for at least one more leg higher as part of an ABC correction. For now, my bias remains bullish above 98.55, with expectations for a break above the 100 handle (and the 38.2% Fibonacci level), and for the USD Index to retest the 3 April low near the 50% retracement level.

EUR/USD: Head and Shoulders Top with Bearish Divergence

Naturally, a move lower on the US Dollar Index would also be bearish for EUR/USD over the near term. A head and shoulders top has formed on the daily chart, alongside a bearish divergence on the daily RSI (2). The H&S top projects a target down to around 1.10, though I should note there’s been a growing tendency for these patterns to fall short of their measured objectives — so this approach should be used with caution.

However, EUR/USD closed right on the neckline of the H&S top and now looks like it wants to retest the 2023 and 2024 highs near the monthly pivot point at 1.1215. A break beneath this level would bring the 1.11 handle into focus.

Japanese Yen (USD/JPY), Swiss Franc (USD/CHF) Technical Analysis

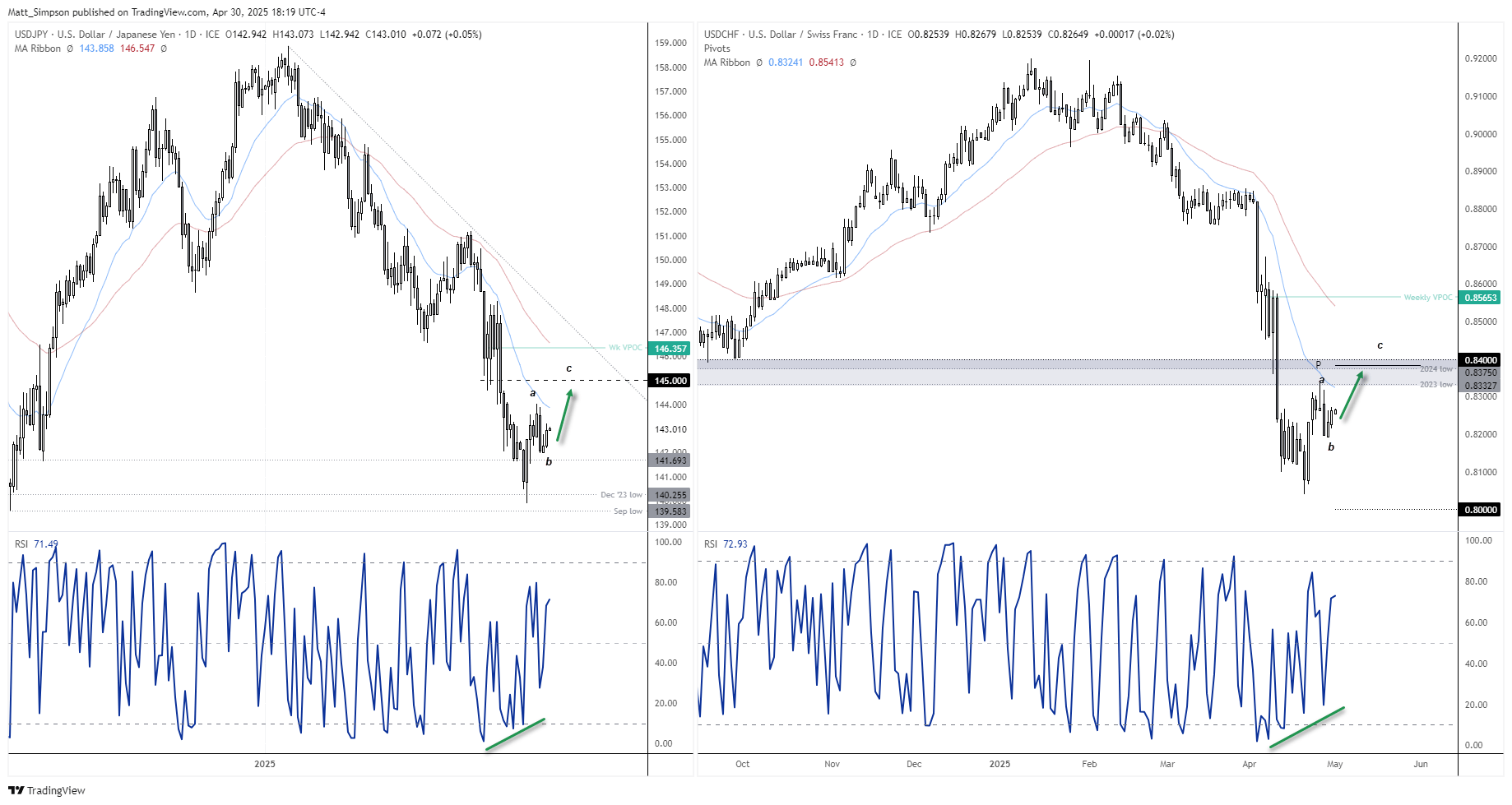

This setup is essentially an all-or-nothing play on the US dollar. With FX majors so closely aligned, a bounce in the US Dollar Index could translate to upside in both USD/JPY and USD/CHF — or it could fizzle entirely.

USD/JPY: Bounce in Play Toward 145–146.35

USD/JPY found support just above the December 2023 low earlier this month, following a false break beneath it. A first leg higher (wave A) has materialised, and I’m now looking for a move toward 145.00.

However, if we apply wave equality (where wave C = A), a more ambitious target lies near 146.35, which also aligns with the volume point of control (VPOC).

USD/CHF: Another ABC pattern in focus

The Swiss franc selloff paused just shy of the 0.80 handle, and like USD/JPY, USD/CHF appears to be forming an ABC correction. Wave equality here sits just below 0.85, although there's a resistance cluster around 0.84 that could act as interim resistance.

That said, with the Swiss National Bank (SNB) threatening a return to negative rates to suppress franc strength, traders should also remain alert for a potential break above 0.84 — particularly if the US dollar mounts a broader rebound.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge